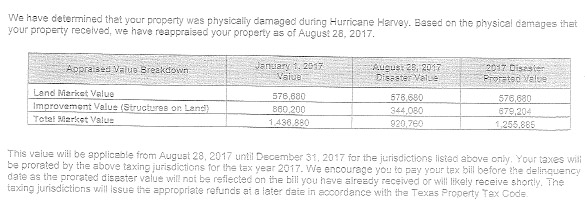

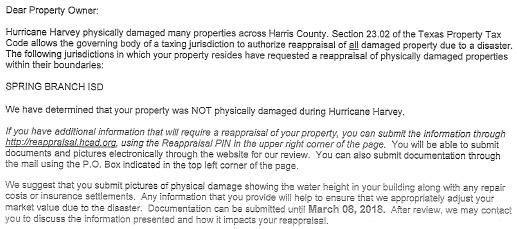

As a result of Hurricane Harvey, some taxing entities have agreed to reappraise properties in their district for a portion of 2017 values. Some appraisal districts have issued reappraisal notifications informing property owners of the new appraised value and the dates for which it is applicable to their tax bill.

If you have received a letter regarding a change in your property’s value or a notice that “your property was NOT physically damaged,” you may be wondering what action, if any, needs to be taken. At Property Consulting Group, it is our job to stay on top of the latest in commercial property tax appraisals and values, so we have outlined what you need to know:

- If you agree with the letter’s assertion and new appraised value, there is nothing you need to do. As taxes should have already been paid, refunds will be issued.

- If you disagree with the new value, you can submit the relevant information to support your disagreement. If you need help doing so, please let us know.

- If your letter says, “your property was NOT physically damaged,” but it actually was, you need to submit that documentation to your appraisal district. The appraisal districts don’t know what they don’t know, so you will need to tell them. If you need guidance with this process, please contact us.

Call or contact our team today at (281) 880-6500 if you have any questions about Hurricane Harvey reappraisals in your district. Our experts specialize in commercial property tax protests for Houston, Galveston, Dallas, Ft. Worth, Austin, and San Antonio, Texas property owners.

No responses yet